SETTING UP ACCOUNTS IN QUICKEN SOFTWARE

What good does it do to buy software you don’t understand? I am aware that many CPAs encourage clients to get QuickBooks because they know it.

If the lawyer for whom you work does not need either of these functions, QuickBooks would be a waste of money. There are two bonafide reasons to get QuickBooks: you need it to do payroll and you’re willing to compromise to get an “okay” billing program. It doesn’t require a sophisticated understanding of a complex program (QuickBooks) It is almost impossible to screw up (anyone can grasp setting up client matters in a tag list and tagging transactions) Best of all it is cheap. I continue to believe Quicken is a straightforward, simple solution for trust accounting. I can then send you the instructions for setting up a lawyer trust account in Quicken.

I would have to know which version of Quicken the lawyer is using. If every transaction is tagged (or the proper class used) then Reports can be generated showing all client trust activity or a particular client’s trust activity. In Quicken, client trust funds are tracked and identified by using the “Class” feature – each client is a class and you enter the Class whenever you post a transaction – OR funds are “tagged.” The “Class” feature appears in older versions of Quicken the tag list approach is used in newer versions of Quicken. Enter an August 1 deposit for Client A in the amount of $200, a $300 deposit on August 1 for Client B, and a $500 deposit on August 1 for Client C. For example, Clients A, B, and C have July 31 trust balances of $200, $300, and $500 respectively. Regarding the year-to-date IOLTA client balances – do you mean you wish to take those balances from QuickBooks and start tracking them in Quicken? If so, I would enter them into Quicken as a deposit for each particular client and go forward from there. Separately, those transactions must be folded into QuickBooks so they appear on the actual client bill and get credited or debited from the client’s account receivable account. For example, client has funds in a retainer account tracked in Quicken with disbursements and deposits recorded there on the client’s behalf. Not sure why he wants to use QuickBooks for his operating account and Quicken for his Trust Account – seems like this would lead to extra work. If you think you might want to use Quicken for trust accounting, see the step-by-step instructions here. It fits their pocket book and their comfort level with technology. Is this a pretty basic solution to trust accounting? Absolutely! And that’s the beauty of it for some folks.

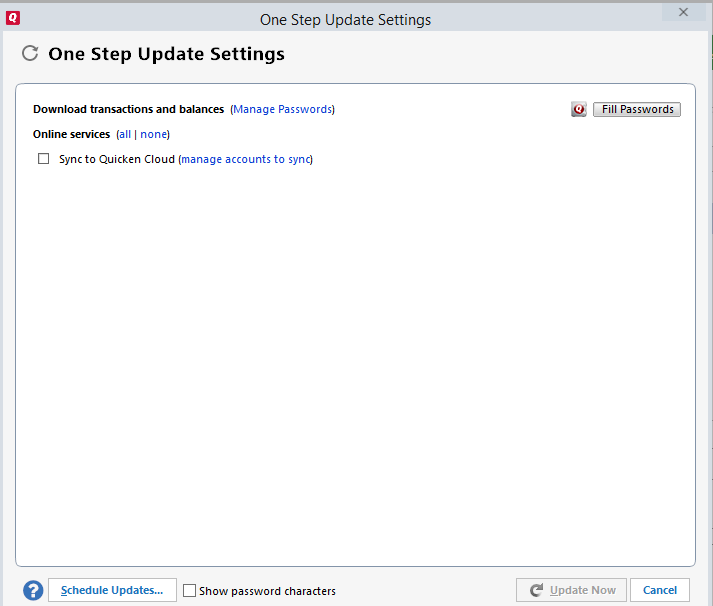

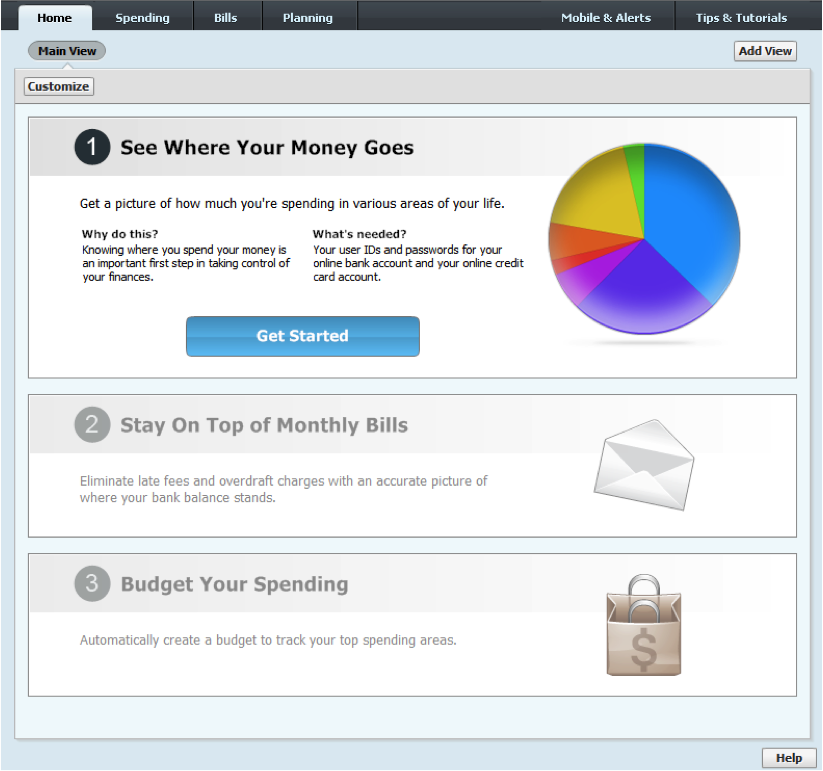

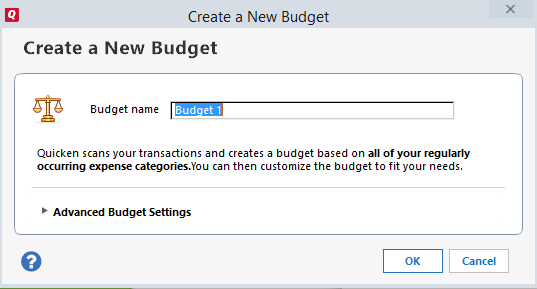

Select “Clear All,” then check the desired client’s name, and click OK. To see transactions for one client only, access your saved Report, click on Customize, then click on Tags. Save the modified report, add it to your toolbar for easy access, and you’re ready to go. Modify the standard Transaction Report by including all dates in the date range and asking Quicken to subtotal by Tag and sort by Account/Date. You can reap the benefits of using the Tag List when you create and run reports. By tagging transactions, you can easily track payments and deposits on each client’s behalf. If the client does not already appear, he or she can easily be added. While in the category field, click Tag List in the Quicken toolbar and select a client from the Tag List. (Remember we added this feature to the toolbar?) As each transaction is entered, it is categorized. Create Expense categories and subcategories for client costs. For example, create Income categories for Retainer and Settlement Funds. Next, add appropriate law office income and expense categories. (More on that in a moment.) Adding it to the toolbar makes it easier to associate deposits and payments with a particular client or matter. The Tag List is the means by which individual client funds are tracked. Ask to see all toolbar choices, then add “Tag List” and “Reconcile an Account…” to the toolbar. Once the account is created, the next step is to customize the toolbar. Begin with a zero balance.Ĭustomizing the Toolbar for the Law Office For example – if you opened your trust account on January 10, 2011, use January 1, 2011 when you set it up in Quicken. Create the account using the first day of the month when your account was opened. This allows you to enter transactions manually instead of connecting to your bank online. Use the “Advanced Setup” feature when creating your account. Recently I updated our detailed instructions for setting up a trust account in Quicken 2011. Granted, Quicken is not a full-fledged accounting program – no dispute there – but it is often the only affordable solution for lawyers opening a new practice. Years ago my friend and colleague Dee Crocker developed instructions for using Quicken for lawyer trust accounting.

0 kommentar(er)

0 kommentar(er)